The COVID-19 pandemic has shaken the world and caused lockdowns, quarantines, and medical emergencies never seen before in the lives of most humans alive on Earth at this time. One early and widely-adhered to medical recommendation was to minimize dining in restaurants to prevent the airborne spread of COVID-19.

The result is that most restaurants have resorted to take-out and delivery with only limited re-openings beginning in more populous areas. A financial effect of this has been that some restaurants have suffered financially but not due to any error they have made themselves to cause this situation.

The U.S. government initially extended fairly robust financial support to the businesses that found themselves in financial straits due to the Shelter In Place orders and restrictions on businesses.

Yet, some businesses found themselves under public pressure to return government loans as they were well-known, publicly-traded, or otherwise thought to be sufficiently financed. Ruth’s Hospitality Group, owner of Ruth’s Chris Steakhouse, a high-end chain steakhouse, was one such company.

With full-scale indoor dining restricted due to health-related restrictions, Ruth’s Hospitality Group saw its quarterly revenue fall from $106MM for Q1 2020 to $27MM for Q2 2020. This drop in revenue is entirely explained by COVID restrictions. One could then argue that the company ought to tap into available government lending programs to retain staff, pay vendors, and sustain a minimum business.

But the firm faced criticism for its taking a PPP loan. One aim of the PPP loan program – along with that of the Fed’s myriad monetary actions – is to keep the cost of funding for businesses somewhat in line with pre-COVID costs of funding to sustain businesses in dire straits.

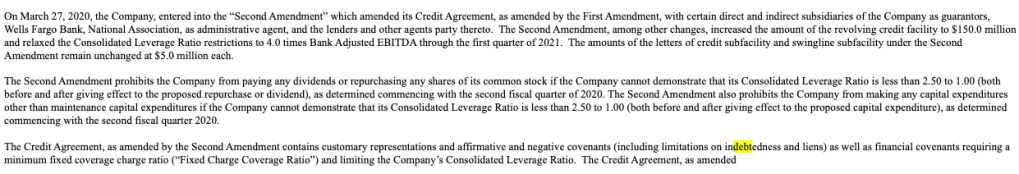

Using a somewhat crude CAPM model (weekly returns vs. SPY), it looks like the cost of capital was around 3% in the pre-COVID world using two years of weekly returns ending on 2/1/2020:

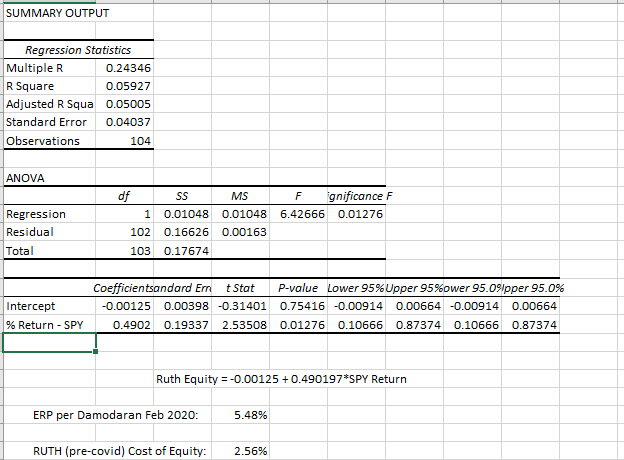

Though fewer data points can be used to estimate the post-COVID CAPM cost of equity, since COVID has only been around since March, the cost of equity has shown a dramatic spike to 19%, a 9x+ increase using weekly returns since 02/01/2020 through 10/21/2020:

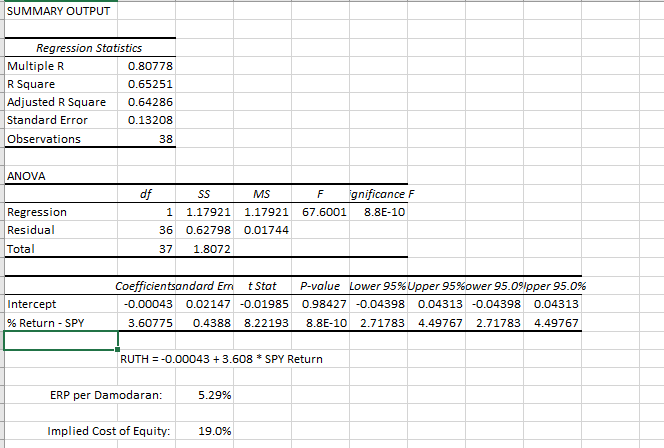

CAPM is imprecise and the math shown here would be subject to various critiques from financial academics – beta is not adjusted for leverage and weekly % returns are subject to noise, among other things – but the core point would likely stand under any other measurement: the cost of capital for Ruth’s Hospitality Group has spiked dramatically, despite its access to capital markets. The firm has issued millions of commons shares as recently as May 2020. Indeed, the company has suspended its dividend and taken other measures in an effort to shore up its balance sheet after taking on new debt in late March 2020.

On some level, businesses with acute exposure to COVID-19 do deserve a bailout from PPP loans or other government sources. The notion that businesses that have access to other funding sources simply because the firm is publicly traded reflects an unrealistic binary and is shown here to be a harsh edict if full recovery for hard-hit businesses is the goal.

Ruth’s Hospitality Group has seen its access to debt market curtailed as shown by added covenants including the suspension of dividend, damaging expected returns to equity holders, and a corresponding spike in the cost of equity as shown in the (roughly done) CAPM models here. The local Ruth’s Chris Steakhouse in this author’s neighborhood has remained closed since March by local government orders by no fault of the firm and provokes the question: should the cost of that closure be borne entirely by the firm?