Thank you for coming to this online space for observations about various securities. For my first post, I’d like to observe an oddity in the current 1Mo. LIBOR rate as it compares to the target federal funds rate.

At the time of this writing, the 1-Month LIBOR rate, a measure of short term credit risk that is reflected in the reported rates that large banks charge each other for overnight loans, is 2.482%. By contrast, the upper limit of the target federal funds rate is set at 2.50%. The federal funds target rate is the upper limit of the rate charged to banks which borrow from the Fed, a routine part of banks’ operations.

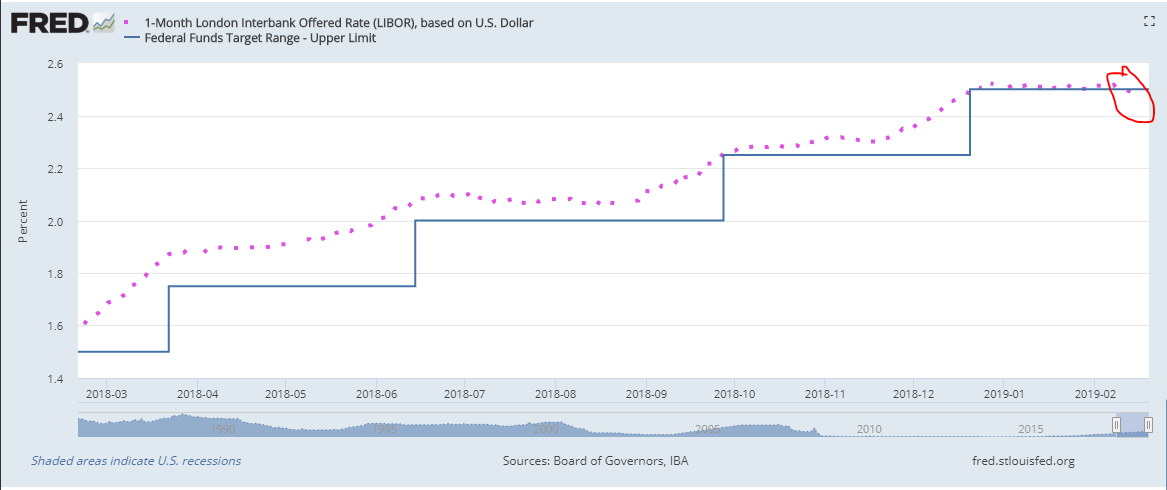

As you can see in the chart below, the 1Mo. LIBOR has been a fairly reliable indicator of forthcoming rate hikes by the Fed, wherein they increase the upper limit of the target federal funds rate. Recent data points, particularly readings like today’s 1Mo. LIBOR showing up below the target fed funds rate. The meaning of this is that there is now a small probability, say 10-15%, that the Fed may actually cut rates over the next year.

Following a December 2018 rate hike, this is a surprising turnaround. Only five months ago, many thought at least one and as many as four rate hikes might be implemented in 2019. Now, banks are making short term loans to each other which, on average, fall below the target fed funds rate meaning that they anticipate a low-rate environment over the near term. Indeed, rates may even fall.